Connecting disparate business applications is a strategic imperative for modern enterprises seeking operational efficiency and accurate data. The synergy between customer relationship management (CRM) and financial accounting systems is particularly crucial. Establishing a seamless flow of information between a leading CRM platform and a widely used accounting solution enables organizations to bridge the gap between sales activities and financial realities, fostering a holistic view of customer interactions and revenue streams. This linkage eliminates manual data entry, reduces discrepancies, and provides real-time insights critical for informed decision-making.

1. Core Benefits of System Interconnection

The strategic combination of sales and accounting platforms delivers multiple advantages, enhancing overall business performance.

2. Enhanced Data Consistency

Maintaining a single source of truth for customer and transaction data is paramount. When sales orders, invoices, and payment statuses are automatically synchronized between the CRM and the accounting software, the risk of data duplication and errors is significantly minimized. This ensures that all departments operate with the most current and accurate information, improving reliability across sales, finance, and customer service.

3. Streamlined Workflows

Automating the transfer of information between the customer management and financial systems significantly reduces manual effort. Processes such as converting CRM opportunities into invoices in the accounting system, updating payment statuses in customer records, and tracking sales commissions become more efficient. This automation frees up valuable time for employees, allowing them to focus on higher-value tasks rather than repetitive data entry.

4. Improved Financial Visibility

Linking sales activities directly to financial records provides a comprehensive view of a business’s financial health. Sales teams gain immediate access to customer payment histories and credit statuses, while finance departments receive real-time updates on sales pipelines, closed deals, and revenue recognition. This integrated perspective empowers better forecasting, budgeting, and overall financial management.

5. Superior Customer Management

A unified view of customer interactions, encompassing both sales engagement and financial transactions, allows for more personalized and effective customer service. Representatives can access a complete history, including past purchases, outstanding invoices, and payment behavior, facilitating more informed conversations and proactive problem-solving. This contributes to enhanced customer satisfaction and loyalty.

6. Practical Advice for Implementing the Connection

When establishing the bridge between your CRM and accounting systems, consider these practical steps to ensure a smooth transition and optimal performance:

1. Thorough Data Mapping: Clearly define which fields and modules will synchronize between the two systems. A detailed mapping plan prevents data conflicts and ensures that information flows precisely as intended, covering customer details, product catalogs, invoices, and payments.

2. Conduct Pilot Testing: Before a full-scale deployment, test the connection with a small set of data or in a sandbox environment. This allows for the identification and resolution of any issues or unexpected behaviors without impacting live operational data.

3. Leverage Automation Rules: Maximize the benefits of the connection by setting up automated rules for data transfer. Configure triggers for actions like creating an invoice upon closing a deal or updating a customer’s payment status, reducing manual intervention and ensuring timely updates.

4. Regular Auditing and Reconciliation: Implement a routine schedule for auditing synchronized data. Periodically reconcile key financial figures and customer records between both systems to verify data integrity and consistency, addressing any discrepancies promptly.

7. Frequently Asked Questions about System Connection

What core functionalities are typically connected when combining these platforms?

Commonly connected functionalities include the synchronization of customer accounts, contact details, product/service lists, sales orders, invoices, payments, and credit memos. This ensures a consistent view of the sales and financial lifecycle.

How does this connectivity enhance financial reporting accuracy?

By providing real-time data flow from sales activities into the accounting system, the connection ensures that financial reports reflect the most current sales figures, revenue recognition, and accounts receivable, leading to more precise financial statements and projections.

What impact does it have on sales and accounting department efficiency?

The automation of data transfer significantly reduces the need for manual data entry and reconciliation, freeing up staff in both departments. Sales teams gain insights into customer financial standing, while accounting teams benefit from immediate access to sales transaction details, accelerating the quote-to-cash cycle.

Are there specific data types that benefit most from this synchronization?

Customer contact information, billing and shipping addresses, sales order details, product pricing, invoice statuses, and payment records are among the most critical data types that benefit from synchronized updates, ensuring all relevant departments have access to consistent and up-to-date information.

What considerations are important during the initial setup phase?

Key considerations include defining the direction of data flow (one-way or two-way), establishing clear data mapping rules, determining the frequency of synchronization, and planning for exception handling. Adequate preparation ensures a robust and effective setup.

How does a business ensure long-term data integrity after implementation?

Long-term data integrity is maintained through regular monitoring of synchronization logs, periodic data audits, establishing clear internal protocols for data entry in both systems, and staying updated with software version changes and integration enhancements.

The strategic linking of customer relationship management and accounting systems represents a fundamental step towards achieving operational excellence. It fosters a robust ecosystem where sales and financial data coalesce, providing a unified operational view. Such a connection is pivotal for businesses aiming to enhance data accuracy, automate critical processes, and ultimately make more informed strategic decisions that drive growth and profitability.

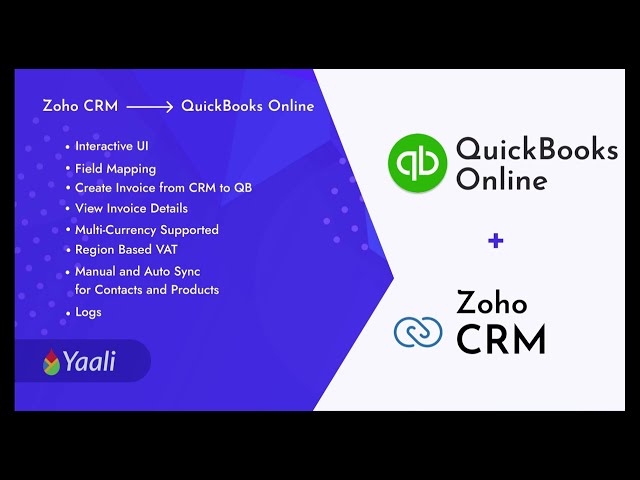

Youtube Video: