The term “VC CRM” refers to a specialized Customer Relationship Management system meticulously designed to meet the unique operational demands and relational complexities inherent within the venture capital industry. Unlike general CRM platforms, these tailored solutions focus on managing the intricate web of relationships crucial for fund success, including interactions with founders, potential portfolio companies, limited partners (LPs), and service providers. This dedicated approach enables venture capital firms to efficiently track deal flow, manage investor relations, monitor portfolio company performance, and leverage data for strategic decision-making, ultimately enhancing both productivity and investment outcomes.

1. Understanding the Core Term

The term “VC CRM” represents a specialized application of Customer Relationship Management principles. In this context, “VC” functions as an adjective, modifying “CRM” to denote its specific domainVenture Capital. “CRM” itself is a noun, referring to the strategies, practices, and technologies used to manage and analyze customer interactions and data throughout the customer lifecycle. Thus, “VC CRM” collectively forms a noun phrase, identifying a system or methodology tailored to the unique relational dynamics of the venture capital industry.

2. Streamlined Deal Flow Management

Central to venture capital operations, a dedicated system provides a structured framework for tracking and managing the entire deal pipeline. This encompasses the identification of potential investment opportunities, initial outreach, pitch assessment, due diligence processes, and the various stages leading to investment. A comprehensive view of all active and prospective deals ensures no opportunity is overlooked and progress is accurately monitored.

3. Enhanced Investor Relations

Effective engagement with Limited Partners (LPs) is paramount for fund raising and ongoing trust. A specialized platform facilitates the management of LP contacts, communication records, reporting requirements, and commitment tracking. This ensures timely and transparent updates, fostering stronger relationships and simplifying compliance obligations.

4. Strategic Portfolio Support

Beyond the initial investment, managing and supporting portfolio companies is crucial for value creation. A tailored system enables the tracking of portfolio company performance metrics, key milestones, and the resources provided to them. It also assists in identifying synergies within the portfolio and facilitating connections, thereby contributing to the success and eventual exit potential of these companies.

5. Data-Driven Decision Making

The centralization of all interactions, deal data, and performance metrics within a single system provides a rich foundation for analytical insights. This robust data enables venture capital firms to identify trends, validate investment theses, assess market opportunities, and make more informed decisions regarding new investments, follow-on rounds, and strategic exits. Such analytical capabilities enhance the firm’s overall strategic agility.

6. Operational Efficiency and Collaboration

Automating routine administrative tasks, standardizing workflows, and providing a shared repository for information significantly boosts operational efficiency. This reduces manual effort, minimizes errors, and frees up investment professionals to focus on higher-value activities. Furthermore, a centralized platform facilitates seamless collaboration among team members, ensuring everyone has access to the most current information and is aligned on strategies.

7. Tips for Successful Implementation

8. 1. Prioritize Customization

Generic solutions often fall short of addressing the specific needs of venture capital. Customizing fields, workflows, dashboards, and reporting templates to align precisely with the firm’s unique investment process and operational nuances is essential for maximizing utility and adoption.

9. 2. Emphasize Data Integrity

The accuracy and completeness of data directly impact the value derived from the system. Establishing clear protocols for data entry, regular data cleansing, and ensuring all relevant interactions are logged are critical for maintaining a reliable and insightful database.

10. 3. Foster User Adoption

The success of any new system hinges on its consistent use by the team. Providing comprehensive training, demonstrating clear benefits, and ensuring the interface is intuitive and user-friendly will encourage widespread adoption and prevent the system from becoming an underutilized tool.

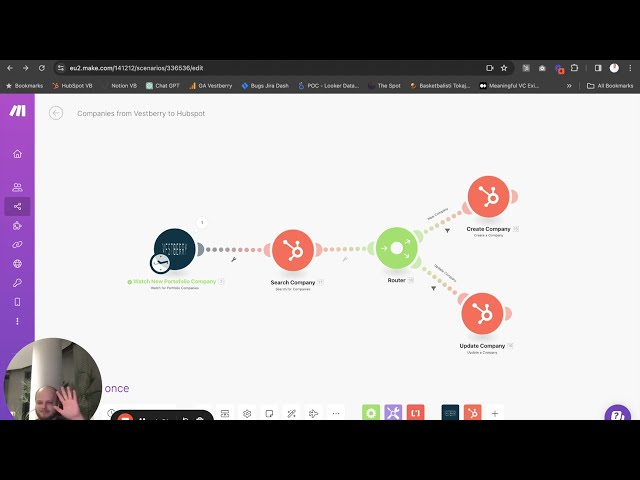

11. 4. Leverage Integrations

Maximizing efficiency involves connecting the system with other essential tools in the firm’s technology stack. Integrating with email clients, calendar applications, financial modeling software, and third-party data providers can automate data synchronization, reduce manual entry, and provide a holistic view of relationships and opportunities.

12. Frequently Asked Questions

What distinguishes a dedicated system from a general customer relationship management platform?

A specialized system is purpose-built with features unique to the venture capital lifecycle, including robust deal flow management, sophisticated LP relationship tracking, and tools for monitoring and supporting portfolio companies, which are typically absent or rudimentary in generic platforms.

Who within a venture capital firm primarily benefits from its implementation?

Investment professionals gain streamlined deal management and insights; investor relations teams benefit from enhanced LP communication and reporting; operations teams achieve greater efficiency and data governance; and firm leadership obtains comprehensive oversight and data for strategic decision-making.

Are there specific features that should be prioritized during selection?

Key features to prioritize include customizable deal pipeline stages, robust contact management for founders and LPs, detailed activity logging, advanced reporting and analytics capabilities, integration with common business tools, and security features to protect sensitive data.

What challenges might arise during its adoption and how can they be mitigated?

Common challenges include initial data migration complexities, resistance to change from users, and the time required for comprehensive customization. Mitigation strategies involve thorough planning for data transfer, comprehensive user training with clear benefit demonstrations, and phased implementation approaches.

How does its implementation contribute to the strategic growth of a venture capital firm?

It contributes by enabling more informed investment decisions through better data, strengthening relationships with founders and LPs, increasing operational efficiency to free up time for strategic activities, and providing a clearer overview of market opportunities and firm performance.

Is a specialized system suitable for both emerging and established venture capital firms?

Yes, scalable solutions exist to meet the needs of firms at all stages. Emerging firms can benefit from structured processes from the outset, while established firms can leverage advanced features for complex portfolios, multiple funds, and extensive networks.

Ultimately, a dedicated system is no longer merely an administrative tool but a strategic asset. Its implementation empowers venture capital firms to manage complex relationships with greater precision, drive more informed investment decisions, and operate with heightened efficiency, thereby positioning them for sustained success in a competitive landscape.

Youtube Video: